Gold IS Money

Everything else is credit!

For the last 4 years or so, Gold, when priced in USD, has seemingly had a cap of USD$2,000 an ounce. The gold price would sometimes hit $US2k/Oz, but then always fall back again. In fact many people (incorrectly) predicted that Gold would never go much past $2k/Oz, as one (also incorrect) theory was that Gold is now fairly redundant in the global monetary system.

Well, Gold has been on an absolute tear recently, and is now up around US$2,400 an Once. As the saying goes, Gold is money, everything else is credit

In fact, did you know that in the US constitution money was defined simply as only “Pieces of Gold and Silver”, and the definition of a US dollar (up until the creation of the Federal Reserve), was that the US dollar was literally DEFINED as 1 Oz of Pure Silver. And as Silver and gold used to have a fixed value ratio of 20:1, therefore 1Oz of Gold was worth $20. If you look at US Bank Notes Pre the creation of the Fed, they quite clearly say that they are NOT money, but rather a promissory note to redeem your piece of paper for ACTUAL money (Pieces of Gold and Silver), so basically, a piece of paper that makes carrying your money around more convenient.

If you look at this picture of a 1929 US$5 Note, you can see quote clearly that it states “Redeemable in Gold on Demand at the US Treasury”. The GOLD was the money, and the paper was just a receipt for that money.

The interesting thing about using Gold and Silver as money, is that Gold and Silver have had virtually NO inflation or deflation in Value over 2,000 years!

A recent study found that “historically, the realized 10-year rate of inflation has had close to no impact” on the price of gold.

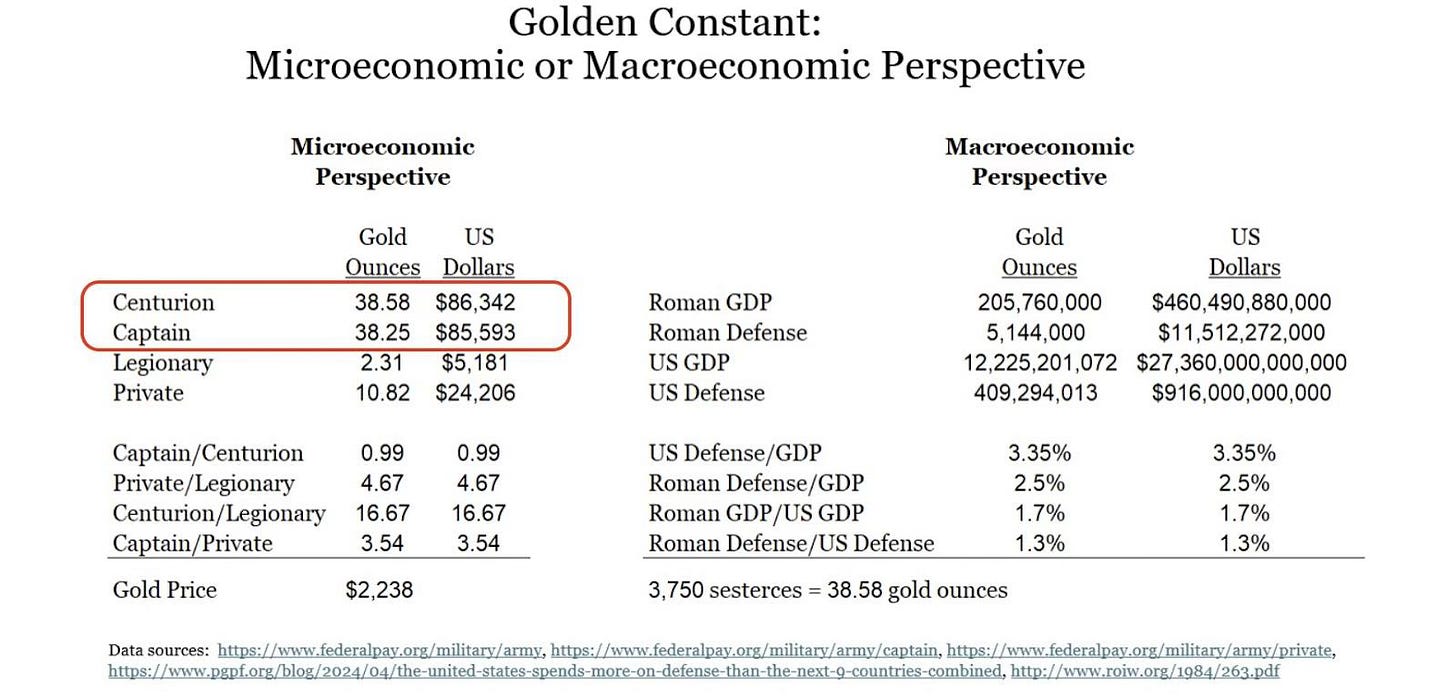

The study notes that in the time of the emperor Augustus, Roman centurions were paid an annual salary of 38.58 ounces of gold, worth $86,342 in today’s dollars.

Amazingly, the modern equivalent of a Roman centurion (a US Army captain ) now makes an annual salary of — wait for it — $85,594.

Another way of looking at the rapid price increase of Gold recently from US$2,000oz to US$2,400Oz, is not that Gold is going UP in Value - it isn’t - because, remember Gold IS money - it’s rather that the Value of the US dollar when measured in Gold - A fixed value item for the last 2,000 years - as demonstrated, is FALLING.

Now, it’s also not just the US dollar, it’s also all other currencies. The problem you see is that money for the last 100 years is no longer defined in Gold and Silver, but as rather ones and zeroes in a central bank computer, and Politicians just can’t help themselves on the matter of creating more.

You see, Politicians LOVE inflation, because it’s a way of getting money from the public by stealth. You see, All governments are broke, they only have what they can take from the people, and there are only 3 ways to get money from the people:

Direct Taxes - Politicians hate introducing taxes (although they do it anyway), because they public can understand them, and naturally hates them

Go into Debt - Well, the USA and most other countries are also going into debt, and this also is unpopular with voters, but less than taxes

Create inflation - by creating inflation, this allows governments to steal the purchasing power of the citizens, and the best part is that they can blame it on “Greedy Businesses” for increasing prices.

Now, during COVID, most governments opted for money printing, but this doesn’t create any value. If there is still the same amount of “stuff” in a country or an economy, and suddenly there is twice as much money, then eventually all the “stuff” will cost twice as much when priced in dollars, which is why we are seeing all this inflation now, after Covid has ended.

So, Why Gold?

Buying gold as a private citizen isn’t going to make you money, gold IS money. It’s simply going to stop your government from stealing your money’s purchasing power. So if you have $100,000k in the bank. Convert it to Gold, and you won’t lose 10-20% of your savings per year, which is what’s happening at present.

Lobby your government to return to a gold standard. The instability in the world is all because we allow politicians to print money, stealing our purchasing power, and then use this purchasing power for whatever they want (in the USA think the $3Trillion war budget). A return to the gold standard would prevent governments from being fiscally irresponsible, and force them to tax and budget with the population honestly.

If you decide to buy Gold for yourself, always buy ONLY physical gold! Many gold ETFs or Gold options are a scam, where they say they have the gold, but in fact they are over-subscribing like a bank does, and lending the same gold out to multiple people